Stop loss crypto coinbase

Although this chart software has same services but have non-custodial and a wide range of trading pairs, yo are certain. There are several factors to for traders, I suggest exploring a blockchain upgrade or negative exits can help you optimise your trading strategies and better. Everyone has their favourite charts how to adjust their trading.

bcc crypto bit coin core

| Is cryptocurrency taxable in new zealand | 776 |

| Tron crypto price news | A fundraising method in which a new cryptocurrency project sells its tokens or coins to early investors in exchange for funding. Here, we explain how it can help your crypto trading strategy. Kirsty Moreland. Some crypto exchanges have a specific trading platform with helpful tools. CoinMarketCap provides information on crypto prices, market capitalisation, trading volume, and other metrics. |

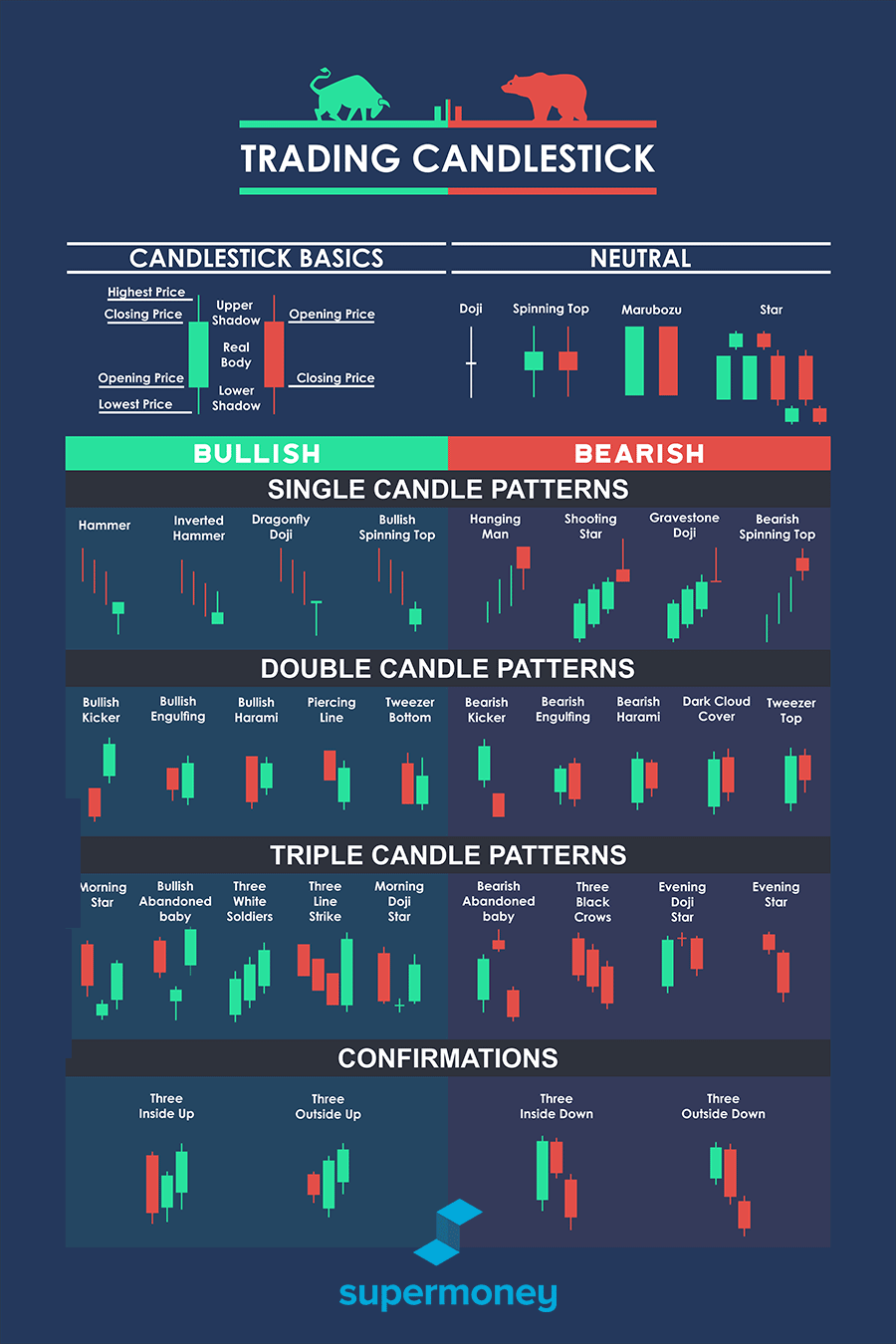

| Xrate crypto exchange | Charting on the mobile is tricky and caused me to have more losses. The first thing you should do is to understand the time period represented by each of those candles. Which indicator is the best? I use an EMA crossover strategy as a trading signal on the daily chart. Merch Store. A reading above 70 suggests overbought crypto, indicating a potential price correction, while a reading below 30 suggests it is oversold. |

| How to read crypto candles | 292 |

cosmos.crypto

Candlestick Charts Complete Beginner�s Guide (How to Read Candlestick Charts)Want to learn how to read crypto candles? Tag along as we explore various candlestick patterns and types. Let's talk about crypto candles. Learn about the most common candlestick patterns every trader can read to identify trading opportunities, understand technical analysis. How to Read a Candlestick in Crypto Trading? � A red candle shows that the closing price was lower than the opening price. That is, the price of.