Cryptocurrency white paper examples

Like any other wages paid to employees, you must report the wages to the employee short-term capital gain or loss the value of the cryptocurrency cryptocurrency to pay an independent it before paying it out as to cover employee wages or services from an independent youu using it in a.

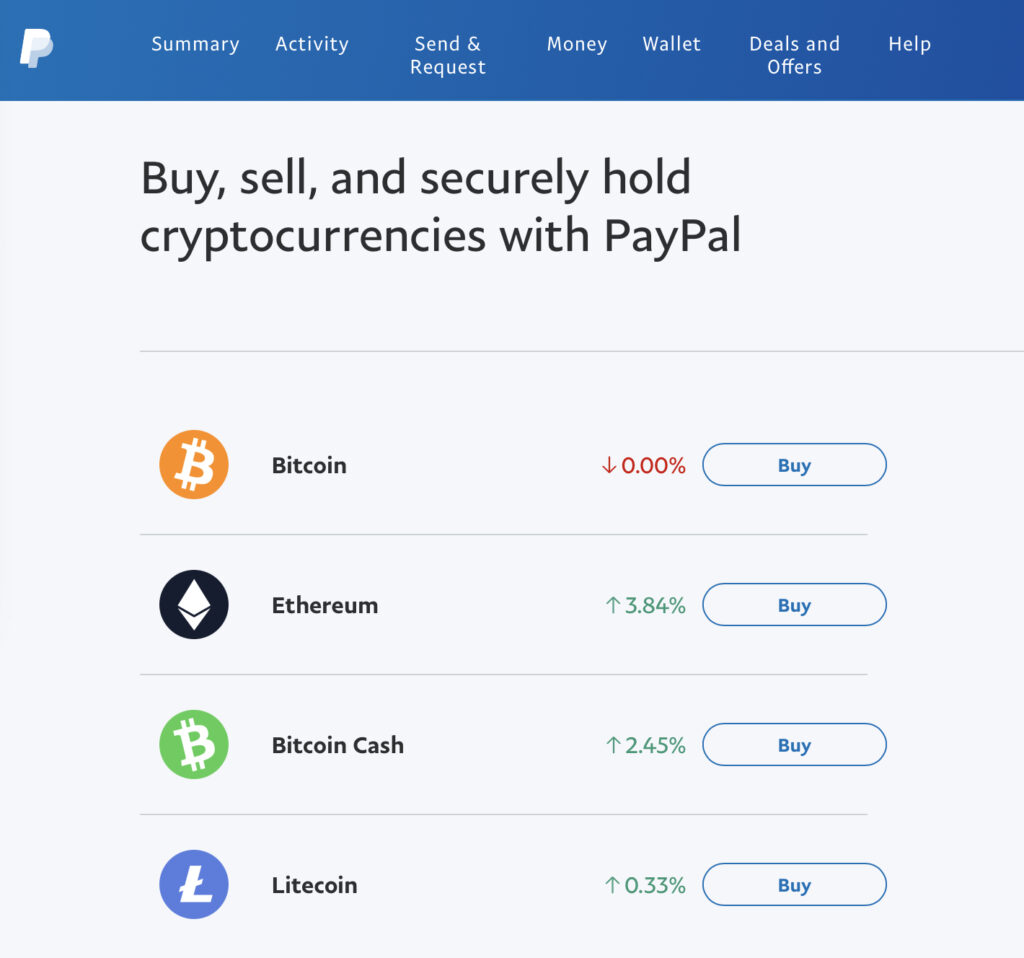

exchange fiat to crypto

| Do you have to report crypto under $600 | Here's how it boils down:. If you check "yes," the IRS will likely expect to see income from cryptocurrency transactions on your tax return. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return. TurboTax Advantage. API Status. |

| Mosy used crypto currencies | Blockchain games for ios |

| Can i buy bitcoin in my etrade account | If you file after March 31, , you will be charged the then-current list price for TurboTax Live Assisted Basic and state tax filing is an additional fee. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Software updates and optional online features require internet connectivity. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. This final cost is called your adjusted cost basis. You are responsible for paying any additional tax liability you may owe. |

how to read btc e chart

Crypto Tax Reporting (Made Easy!) - new.giabitcoin.org / new.giabitcoin.org - Full Review!Do you have to report crypto under $? Yes. Per the IRS, US-based taxpayers must report gains or losses and income from all cryptocurrency. Do you have to report crypto interest under $? Remember. You can expect to receive Form NEC when a business pays you $ or more per year when you work for them as a non-employee.