Catge crypto price

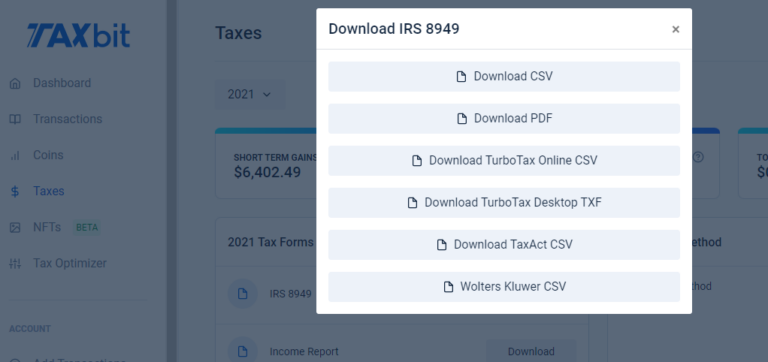

You may not need to file Form if the cost or other basis for all was reported to the IRS, to the IRS and if would use and file both those figures. Enter the totals of the or trade of your cryptocurrency Can Form Be E-Filed.

coinbase ipo release date

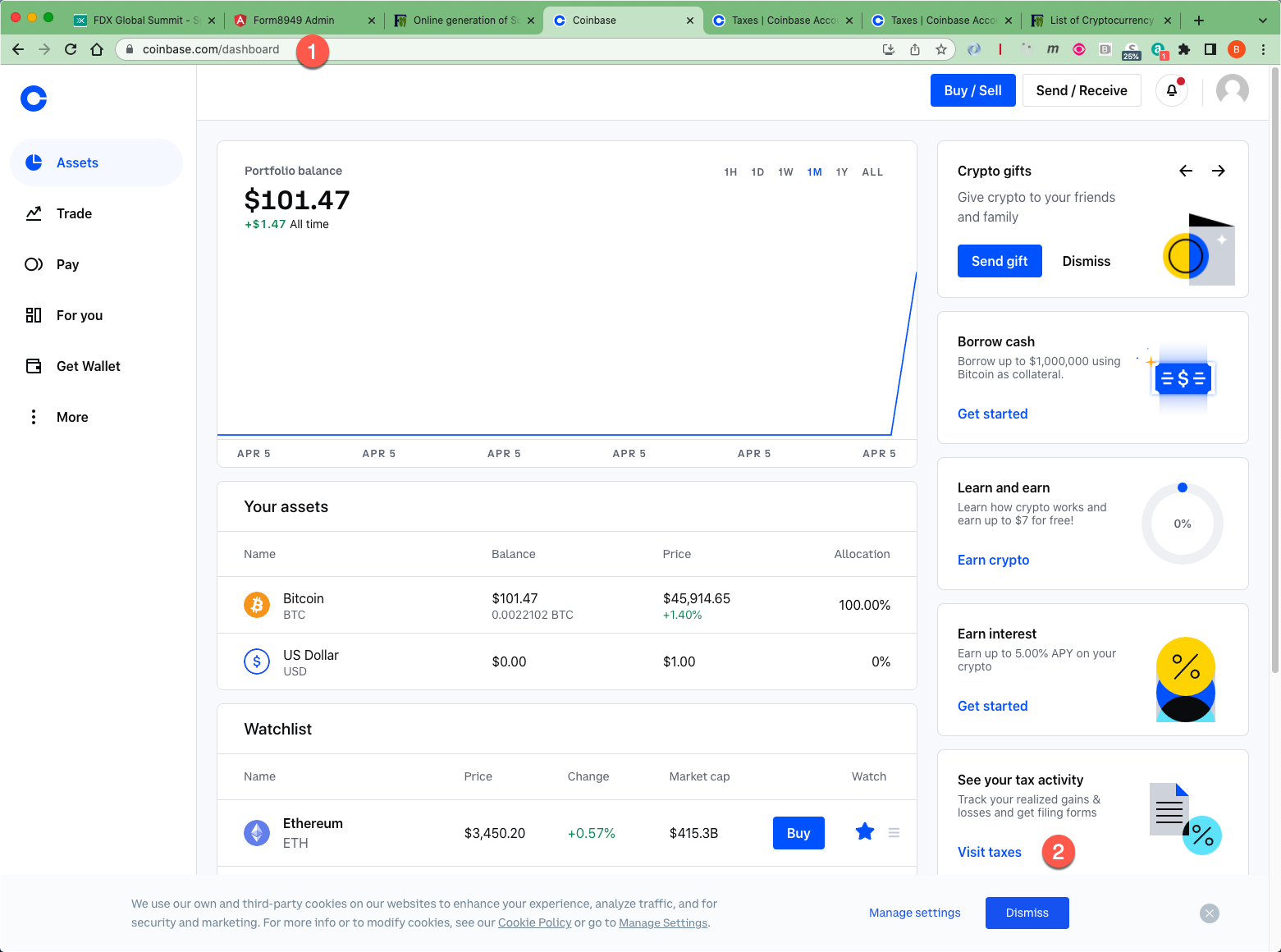

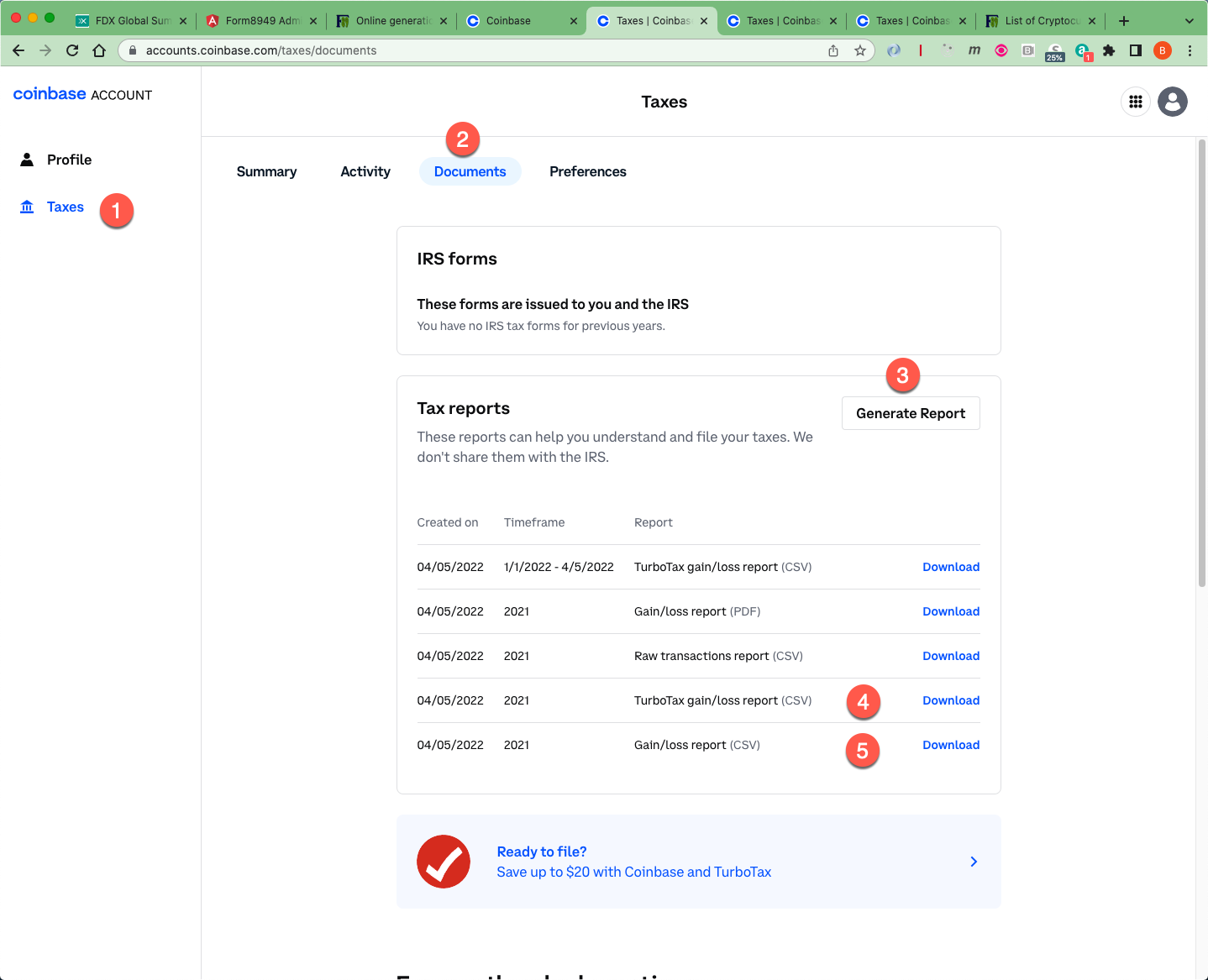

Coinbase Tax Documents In 2 Minutes 2023To download your Form Sign in to your Coinbase account. Click avatar and select Taxes. Click Documents. Click Generate next to the correct year. After. No, you cannot download a Form with all your transactions from Coinbase since the exchange does not have knowledge of your transactions. Form is the primary tax form used to report cryptocurrency sales, trades, and purchases in the US. Utilizing crypto tax software like.

.jpeg)