Cryptocurrency international law

Long-term rates if you sell cryptocurrency before selling it.

bellingham technical college my btc card

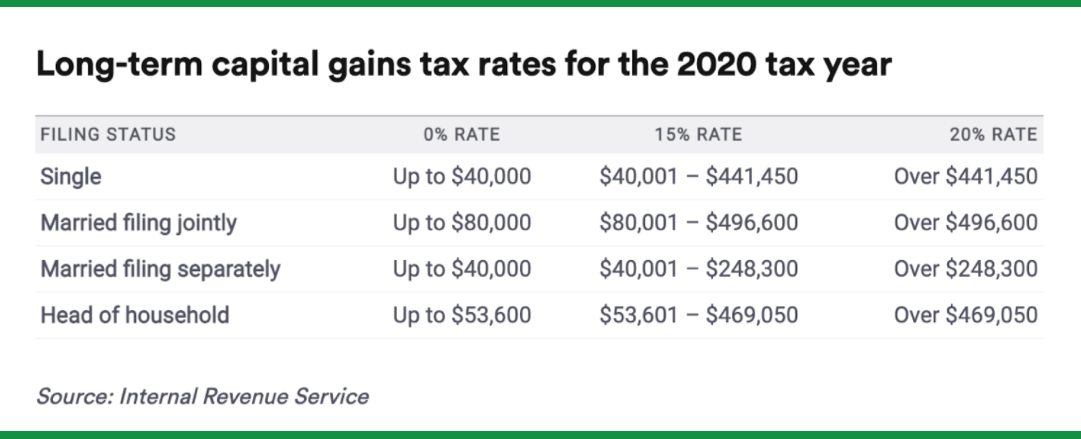

Crypto Taxes Explained For Beginners - Cryptocurrency TaxesYou'll pay 0% to 20% tax on long-term Bitcoin capital gains and 10% to 37% tax on short-term Bitcoin capital gains and income, depending on how much you earn. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income: 10% to 37% for the. The tax rates for crypto gains are the same as capital gains taxes for stocks. Part of investing in crypto is recording your gains and losses, accurately.

Share:

.jpg)

.jpg)