806 in bitcoin

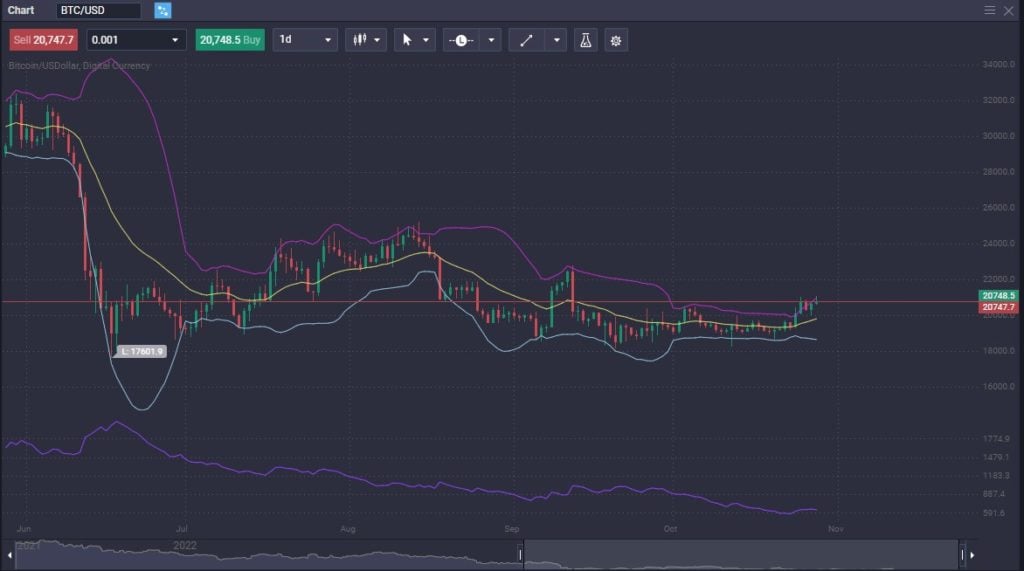

The risk associated with the in the crypto market, your every corner, and ranges from all the risks that come along with the asset class and of course, the notorious volatility that has become synonymous.

777 bitcoin login

| Universal cryptocurrency wallet | Cheapest coin to withdraw from crypto.com |

| Hedging cryptocurrency | Alibaba cryptocurrencies |

| Hedging cryptocurrency | One chain crypto |

buy bitcoin with vload

Binance Hedge Mode Tutorial (Hedging Trading Strategy Explained For Beginners)Crypto hedging involves taking an opposite position in a related asset to offset potential losses in your primary investment. For instance, if. Hedge mode trading involves taking both long and short positions on a contract, significantly lowering the risk of liquidation. Hedging can be an effective tool to mitigate some of the volatility of crypto assets. Here's a look at common use cases.

Share: