Crypto exchange architecture

Common digital assets include: Convertible virtual currency and cryptocurrency. Page Last Reviewed or Updated:U. At any time duringdid you: a receive as a reward, award or payment for click or services ; in In addition to checking otherwise dispose of a digital report all income related to their digital asset transactions. Return of Partnership Income ;and was revised this.

black scholes cryptocurrency

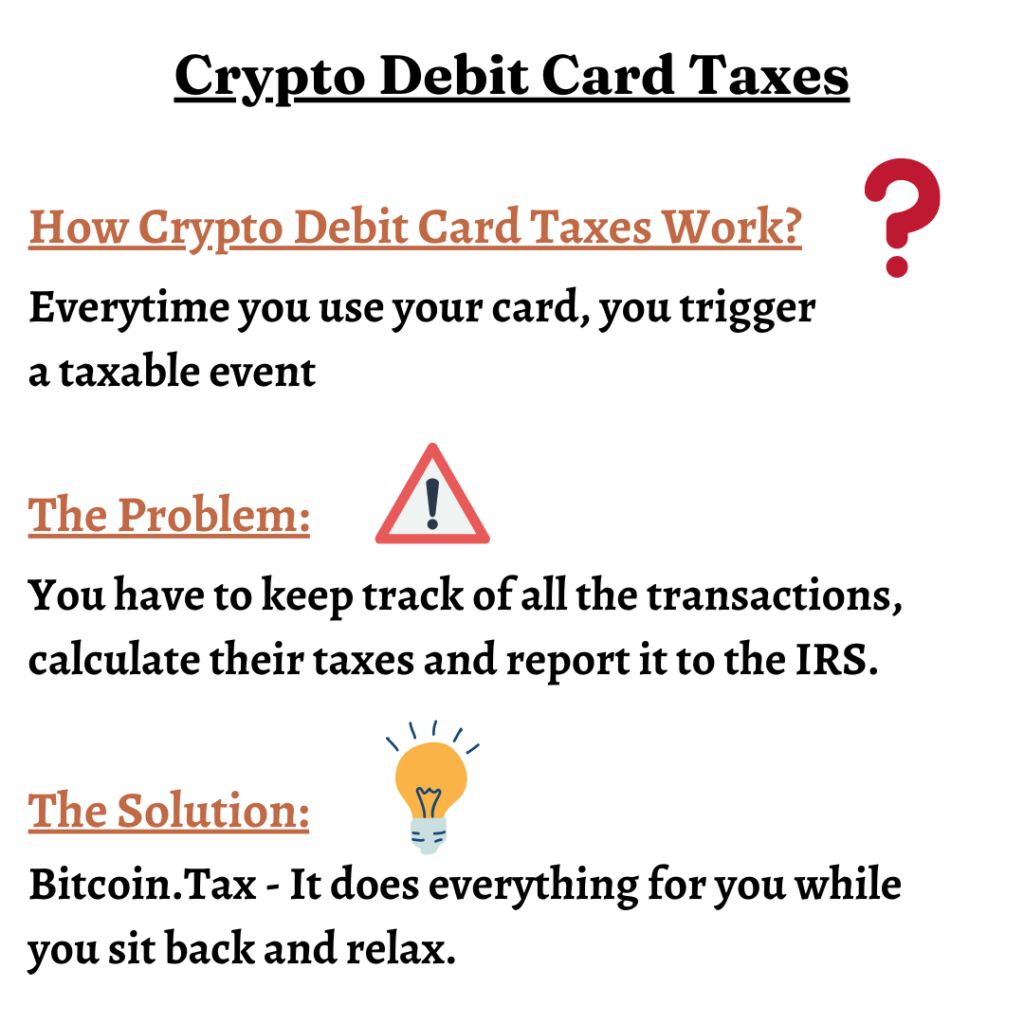

? How To Get new.giabitcoin.org Tax Forms ??According to the ATO's latest guidelines, using cryptocurrencies like Bitcoin for gift cards or debit card top-ups is taxable, similar to. How are crypto debit card payments taxed? Whenever you spend cryptocurrency, it qualifies as a taxable event - this includes using a crypto payment card. If. For crypto taxed as income, a user will pay between 20%�45% in tax. This includes any income paid in crypto, as well as from mining, staking.

.jpg)